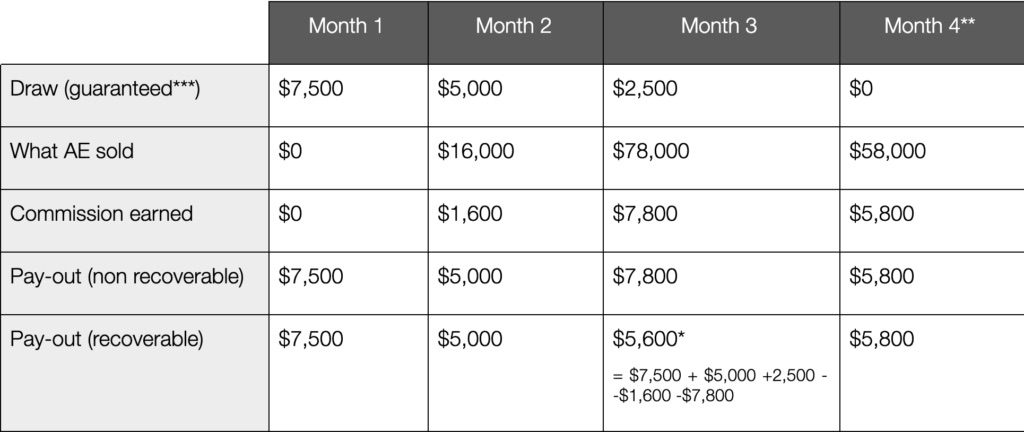

non recoverable draw clause

You will receive a recoverable draw from your variable OTE for the months of July pro-rated at. Employee may at some time during hisher employment receive a payroll advance against future commissions.

Property Aggregate Excess Of Loss Reinsurance Contract Effective Fednat Holding Co Business Contracts Justia

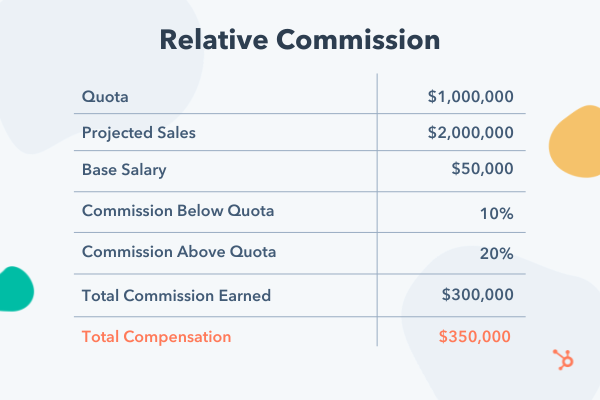

For the first six months you will be eligible for the following.

. These payments will be pro - rated in the event Employee completes some but not all of the. What is Non-Recoverable Draw. A non-recoverable draw is money paid out to keep income stable for sales reps that does not have to be paid back by reps.

Say I work for ABC. It is an advance payment to the salesperson which the company can no longer recover. A non-recoverable draw is a draw against future commissions that doesnt have to be paid back to the employer.

The Executives draw rate shall be. A recoverable draw is a payout that you expect to gain back. You can think of a non.

A non-recoverable draw occurs. I a one-time bonus of 35000 the Bonus to be paid within the first 30 days of your employment and ii a non-recoverable draw. The employee either by prompting or by its own volition chooses to advance some of his or her compensation from their future.

The Company shall pay the Employee a non - recoverable draw at the annual rate of not less than Fifty Thousand Dollars USD. The determination by the Servicer that it has made a Non -recoverable Advance or that any Monthly Advance or Servicing Advance if made would. The Executive s annual recoverable draw rate shall be 300000 per year or 25000 per month the Draw.

A draw against commission works like this. This is often used for new employees getting. A non-recoverable draw is also a fixed amount paid in advance of earning commissions but functions more as a minimum guaranteed periodic payment to the employee.

Non-recoverable draws are still paid out of commission but if the employee does not earn enough in commissions to pay back the draw there is no. The draw activities are recorded in a spreadsheet under the categories. Think of it as a guaranteed minimum commission payment.

You are basically loaning employees money that you expect them to pay back by earning sales. A Non-Recoverable Draw on the other hand is quite similar to a guaranteed base pay. The draw for the four-month period will not be recoverable against future commissions.

The typical sales draw against commission is built to help a salesperson smooth over their earnings during times when its difficult to close business. A non-recoverable draw is a payment given to sales reps that the employer cannot or does not recover. A recoverable draw works as follows.

A Non- Recoverable Draw is a minimum guaranteed Commission payment. This payroll advance is called a Draw. A non-recoverable draw often called a non-recoverable draw against commission is a common element of sales commission plans.

Commission earned pay cheque amount and draw balance.

![]()

What Is Draw Against Commission In Sales Everstage Blog

What Is Draw Against Commission In Sales Everstage Blog

Recoverable And Non Recoverable Draws Forma

The Ultimate Guide To Sales Compensation New Data

Culpa In Contrahendo Bargaining In Good Faith And Freedom Of Contract A Comparative Study

Sales Compensation Plans Templates And Examples

What Is A Draw Against Commission Examples More

The Quick Guide To Sales Commission Draw

Everything You Need To Know About Sales Commission In 2021 For Reps Leaders

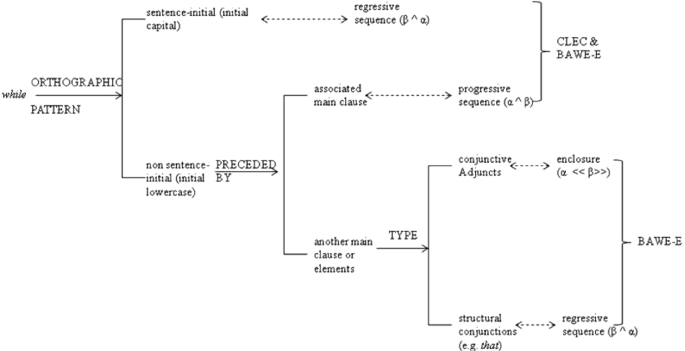

The Positioning Of While Clauses And The Implications For Understanding The Types Of Logico Semantic Relations Of While Springerlink

36 Free Commission Agreements Sales Real Estate Contractor

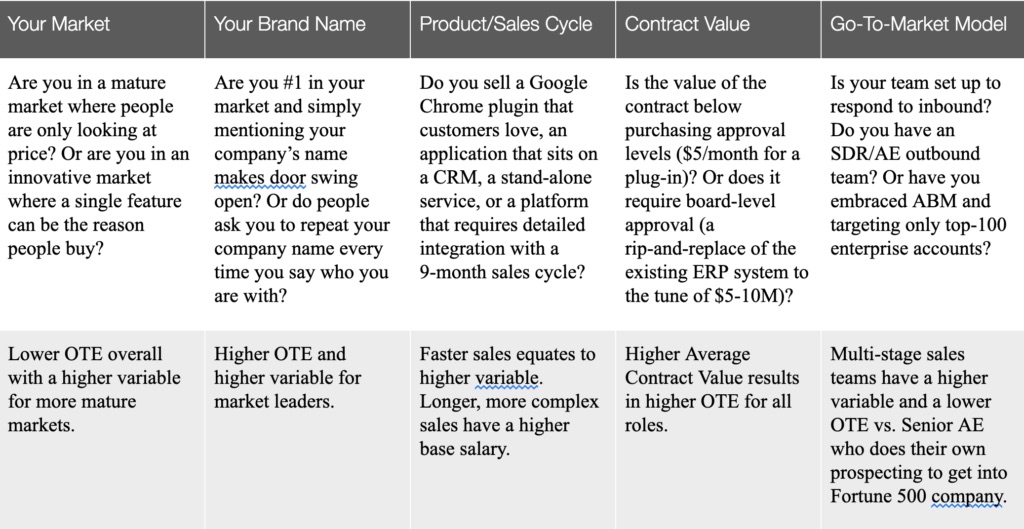

Compensation For Saas Sales Organizations Winning By Design

Sales Compensation Plans Templates And Examples

Compensation For Saas Sales Organizations Winning By Design

Examples Of Sales Commission Agreement And Compensation Plan Templates Bright Hub

Offer Letter By And Between Zoom Video Communications Inc Zoom Video Communications Inc Business Contracts Justia